Free cash flow plays a crucial metric for investors and business owners. It highlights the actual cash generated by a corporation after accounting for its operating expenses and capital expenditures. Understanding free cash flow empowers investors to evaluate a company's financial health, viability, and its potential to generate returns.

This comprehensive guide delves the intricacies of free cash flow, explaining its methodology and providing valuable insights into its relevance for analysts.

Through clear explanations and applicable examples, you'll gain a solid understanding of how to interpret free cash flow strategically.

Whether you're a seasoned investor or just initiating your journey into the world of finance, this guide will equip you with the expertise to conduct more informed investment decisions.

Unlocking Free Cash Flow Calculation: Step-by-Step

Free cash flow (FCF) is a crucial metric for assess a company's financial health and its ability to generate capital. Calculating FCF can seem challenging, but with a clear approach, it becomes a simple process.

- First identifying the company's net income from its financial reports.

- Subsequently, correct net income for non-cash expenses such as depreciation and amortization.

- Also, consider changes in current assets and liabilities.

- Last but not least, subtract capital expenditures to arrive at the final FCF amount.

By following these principles, you can accurately compute a company's free cash flow and gain valuable understanding into its financial performance.

Unveiling Free Cash Flow: Metrics for Portfolio Success

Free cash flow (FCF) acts as a crucial metric for traders seeking to gauge the health of a company. It represents the funds a company generates after paying its operating expenses and capital expenditures. A strong FCF suggests a company's capacity to expand in the future, refund debt, or return value to shareholders.

Understanding FCF can provide valuable clues for making strategic acquisition decisions.

Several key elements influence a company's FCF, comprising its operating margin, capital expenditures, and working funds. Studying these factors can help analysts spot companies with consistent FCF generation, a indicator of long-term prosperity.

Eventually, by decoding the nuances of free cash flow, investors can make more effective investment decisions and align themselves for investment advancement.

Unlocking Value with Free Cash Flow Analysis

Free cash flow (FCF) analysis provides a potent lens for evaluating the financial health and viability of businesses. By examining a company's ability to produce cash flow from its core functions, investors may gauge its potential to deploy resources for future growth, service debt obligations, and distribute value to shareholders.

A robust FCF analysis involves a thorough review of a company's income statement, statement of financial position, and fundamentals. With carefully analyzing these financial statements, investors can identify key insights into a company's performance, capital structure, and growth prospects.

Ultimately, FCF analysis serves as a valuable metric for selecting investment opportunities. Companies with consistently strong FCF production tend to be more resilient and attractive to investors.

Unveiling Free Cash Flow: A Guide for Investors

Free cash flow (FCF) is a fundamental metric that reveals the financial health and potential of a business. In essence, FCF represents the cash generated by a company after accounting for operating expenses and capital expenditures. By analyzing FCF, investors can gain valuable insights into a company's profitability, growth prospects. A strong and consistent free cash flow indicates that a company is effectively managing its operations, generating profits, and more info returning value to shareholders.

- Investors commonly turn to FCF to gauge a company's ability to pay dividends

- Examining FCF over time can provide valuable insights into a company's long-term sustainability

- Moreover, FCF analysis can help investors spot companies that are mispriced

Ultimately, understanding free cash flow is crucial for making informed investment decisions. By incorporating FCF into their analysis, investors can make better-equipped understanding of a company's true value and potential.

Unveiling the Secrets of Free Cash Flow Projection

Predicting free cash flow (FCF) is a crucial art for investors and businesses alike. It involves a delicate balance of financial rigor and strategic insight. A robust FCF projection requires a deep understanding of a company's core competencies, its industry dynamics, and the broader economic landscape. Professionals employ various techniques to forecast FCF, including discounted cash flow (DCF) analysis, regression models, and historical analysis. The accuracy of these projections depends on a multitude of factors, such as the quality of information, the breadth of the business, and the detail of the premises made.

Effectively forecasting FCF is a multifaceted endeavor that demands both analytical expertise and a keen sense of market acumen. By carefully analyzing historical trends, recognizing key drivers, and making sound assumptions, analysts can generate valuable insights into a company's future cash flow potential. This information is essential for investors in making strategic decisions and for businesses in planning their strategies.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Luke Perry Then & Now!

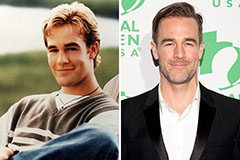

Luke Perry Then & Now! James Van Der Beek Then & Now!

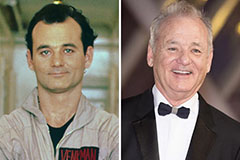

James Van Der Beek Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!